From the shifting landscaping of a home loan, the issues experienced by potential customers are increasing. Traditional banking companies, shortly after credible offer having home loans, is actually firming its requirements, it is therefore even more difficult for people to safer mortgage loans. Due to the fact requirements be more stringent, of several find themselves became out, incapable of access the financing had a need to purchase their fantasy family.

For those for the brink of getting the very first family otherwise provided refinancing, the problem was genuine. not, amidst it suspicion, choice lenders are seen because an excellent lifeline. These businesses focus on delivering approaches to people that dont fit the conventional financing mold.

Are you presently concerned about your credit rating ? Can be your financial situation known as highest-risk, or could you be thinking-functioning, desperate for lending products? When you’re nodding to those inquiries, solution mortgage lenders will be the respond to you’re trying. Even although you faith that you don’t qualify for a mortgage, this type of certified loan providers provide customized selection.

Think about the possibility protecting your perfect household without having any limits of conventional lender conditions. Alternative lenders are created to focus on diverse monetary experiences, giving independency and you will individualized guidance in which old-fashioned lenders fall short.

When you find yourself ready to mention a new way pass on your homeownership excursion, dig higher and see just how this type of option lenders is pave the fresh new opportinity for your.

Option Mortgage lenders

Choice lenders have become pivotal players regarding the credit community, going into the in which antique finance companies have cultivated hesitant. That it shift provides taken place while the banks are particularly all the more reluctant to offer home loans, compelling an upswing of them selection in order to satisfy new surging request having financial resource.

- On the internet Mortgage Programs: These firms embrace electronic programs, enabling applicants to do the borrowed funds app process online. It comfort streamlines the program processes, making it a whole lot more obtainable and successful to possess individuals.

- Individualistic Loan Terms and conditions: Rather than brand new standard terminology offered by banking institutions, alternative loan providers give individualized financing terms and conditions. Borrowers feel the independence so you’re able to negotiate and you will framework terms one line up along with their unique financial issues, making sure an even more customized and you may in check installment plan.

- Fast Application Running: Choice mortgage brokers focus on performance, making certain quick running off apps. Its sleek procedures and you will increased exposure of small turnaround times mean borrowers feel smaller approvals and you may disbursements, cutting prepared episodes significantly.

- Significantly more Alternatives for every Borrower: Accepting the latest varied demands confronted because of the individuals, alternative lenders render many options. If applicants keeps less than perfect credit, bizarre money supplies, or other advanced monetary experiences, these businesses specialize in insights private affairs. For that reason, they may be able design certified mortgage products which target these types of demands effectively.

In instances where antique banking institutions or financial people deny apps, turning to option lenders gets not simply an alternative but a requirement. These businesses part of so you’re able to connection the latest pit, providing tailored home loan conditions and you will energetic choice.

For those up against rejection of traditional source, alternative lenders promote a feasible path so you can homeownership, exhibiting autonomy, results, and an union to approaching exclusive need of each debtor.

1. Less than perfect credit Mortgage

Bad credit presents a serious barrier for people trying to property loan, riding these to explore choice having alternative mortgage lenders. Traditional banking institutions and you will mortgage organizations have a tendency to establish unhelpful throughout these items, deeming people that have poor credit since the highest-risk and rejecting their loan requests downright.

The newest unfair presumption produced by financial institutions is the fact individuals with bad borrowing from the bank will not to able to settle their home financing. Yet not, individuals will see themselves in this case due to various causes, and therefore blanket judgment cannot check out the intricacies out-of individual economic records.

Option mortgage brokers, knowing the multifaceted factors behind less than perfect credit , make an effort to let these types of individuals. Its means changes, aiming to safe home loans without solely counting on credit ratings or money, providing an excellent lifeline to people who or even be unable to accessibility this new housing industry.

2. Bad credit Financial

Poor credit is yet another reasoning you are searching for some one besides your lender to help you that have a property financing.

Someone may have bad credit for a few grounds. This may involve repeated overlooked or later repayments, excessive credit debt, case of bankruptcy, and a lot more.

When a person has poor credit it doesn’t mean one they don’t have earned home financing. Loan providers commonly neglect to envision borrowing and earnings points are not usually new blame of borrower.

B lenders are content to incorporate almost anyone that have an option way to a payment-effective home loan. When someone means a woeful credit mortgage there are lots of alternatives they may be able pick.

step three. High-Exposure Home loan

Banking companies commonly name some body given that high-risk, particularly due to affairs for example worst otherwise poor credit. For those searching for a high-exposure mortgage , solution mortgage brokers, labeled as B lenders, step up to assess its condition and you will mention feasible selection to one another.

About world of high-exposure mortgage loans, about your home loan get undergo alter. Solution mortgage lenders introduce a selection of routes, permitting you the flexibleness to determine just what is right for you best. Your preferences and requirements get cardiovascular system stage, guiding you toward a tailored service.

4. Self-Employed Financial

Whenever you are self-working, getting home financing is problematic. Very loan providers want at least a couple of years from mind-employment background, posing an obstacle getting newly notice-functioning somebody hoping to get property. Even for those with comprehensive worry about-a position feel, write-offs or a low claimed taxable money can boost warning flag, top banks so you’re able to identify them just like the high-risk individuals.

However, trying to find the right notice-functioning home loan isnt impossible, provided you affect the proper professionals. Option mortgage lenders are experts in such cases, knowing the intricacies out-of mind-work. They are willing to assess personal circumstances and provide customized solutions, and come up with homeownership possible for those navigating the unique demands of being self-working.

5. Non-Old-fashioned Money

In today’s varied benefit, people generate income owing to certain unconventional form. not, antique banking institutions and mortgage lenders commonly categorize individuals due to the fact highest-exposure when the its income offer deviate regarding standard.

Consider artisans depending on earnings, baristas influenced by information, or some body engaged in bucks-founded s is also pose pressures when seeking to a mortgage. Of several end up simply for seeking to assistance from B loan providers , because these creditors be ready to understand and match the initial situations away from individuals deriving money out-of non-antique sources.

Within changing landscaping, the need for choice financing choices becomes visible, making it possible for people who payday loans Louisiane have diverse earnings avenues to gain access to the latest property s .

- Unusual area-time jobs

- Income out-of Sky BnB otherwise renting bed room

- Promote care Income

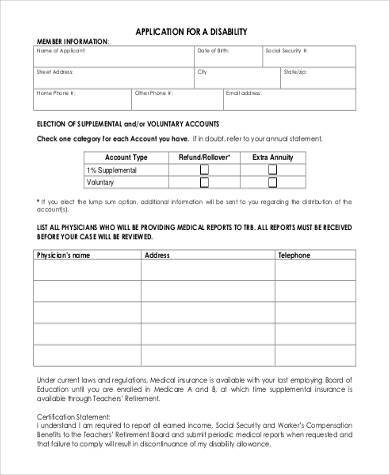

- Income out-of handicap

- Earnings from financial support gains just

- Youngster tax masters

All of these income supply will get enable it to be one to possess loads of money to repay a mortgage. Yet, conventional lenders and you will banking institutions dont find it that way.

Solution mortgage lenders have to manage your situation and you can source cash to allow you to secure home financing.

Comentarios recientes