Perhaps you have questioned exactly what the huge difference is actually between a beneficial 5/step 1 Sleeve and you will a 5/5 Sleeve or an effective 7/step 1 Arm and you may an excellent eight/6 Arm and so forth? I want to establish in this post since huge difference increases yet another trouble financial individuals must look into.

An adjustable-price home loan (ARM) was a mortgage that have a basic repaired Visit Your URL interest upfront, followed by a speeds adjustment after that initial months. The newest introductory fixed rate of interest several months are signified from the basic thumb, i.age. 5-seasons fixed-rate several months to own an excellent 5/step one Case.

The fixed-price months following the initially basic period is more than is actually signified by 2nd thumb, i.elizabeth. 1-season fixed-rates period into the the newest rate to own a 5/step 1 Sleeve.

An important difference between an effective 5/1 and you may 5/5 Arm is that the 5/step 1 Case adjusts on a yearly basis adopting the five-year secure period is more than. While an effective 5/5 Arm changes the 5 years.

Provided we all know Hands make up just a little percentage of total fund, Fingers having an adjustment fixed-speed chronilogical age of multiple 12 months is actually a lot more uncommon. However, why don’t we talk about in any event.

The best Case Repaired-Speed Periods

A supply fundamentally possess a reduced mortgage rates than just a 30-seasons repaired-price mortgage since it is towards quicker avoid of your produce contour. As a result, more folks might remove Fingers given that financial cost wade high.

Within the a great step three/1 Sleeve, the initial fixed rate of interest several months are three years. About usual 5/step one Sleeve, the first fixed interest several months try five years. Privately, I have a great eight/step 1 Sleeve that have an initial fixed-rates ages of eight decades.

Then there’s the new ten/step 1 Arm that have a primary repaired-price ages of ten years. 10/step 1 Possession commonly while the well-known as they begin encroaching towards the new fifteen-seasons repaired-rate mortgage, hence has a tendency to have quite aggressive pricing.

Please be aware there are also eight/six Possession and you can 10/6 Palms! The fresh new six signifies 6 months, not half dozen ages. Put simply, after the basic speed several months is more than, brand new mortgage interest rate will adjust twice a year.

Selecting the Style of Case According to the Produce Contour

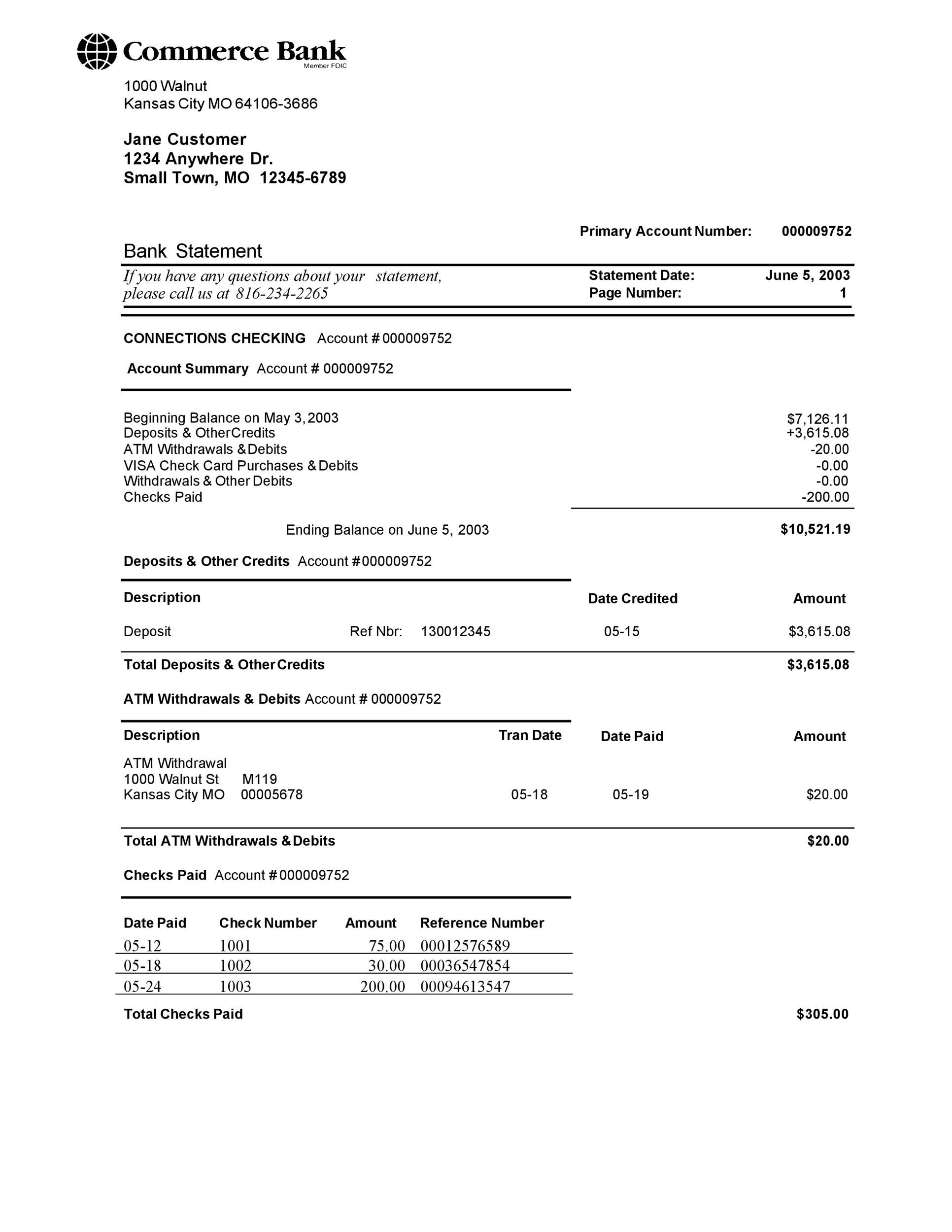

While i got away my seven/step 1 Case from inside the 1H 2020, 7/step one Palms given an informed blend of a reduced rate which have this new longest initially fixed-speed several months as the produce contour is kinked on 5-7-year draw.

Understand the produce contour less than a couple months prior to We secured in my personal seven/1 Case at 2.125% with no fees. The eye pricing to have an effective eight/1 Case was in reality slightly less than the eye costs to possess a great 5/step 1 Arm. Thus, I decided to go the fresh new seven/1 Case station for 2 alot more several years of rate of interest balances. Anyway, I had purchased all of our permanently household.

Prior to taking aside a supply, check out the current yield curve. Pick when the you’ll find any dips regarding the produce bend and you may choose whether or not one fixed-rates course is something you are more comfortable with. The new period where there’s a plunge is the place you’ll have the best well worth.

5/step 1 Sleeve otherwise 5/5 Case?

The greatest difference between the five/1 and you can 5/5 Arm is there are more regular notice-rates changes toward 5/1 financing, i.e. every year versus most of the 5 years. Ergo, if for example the financial pricing and you can can cost you to obtain the financial are equivalent, then it’s far better score a 5/5 Arm than simply a 5/1 Arm.

not, there’s no 100 % free dinner with respect to providing an effective mortgage. Actually zero-rates refinances has can cost you. The purchase price is simply in the form of a high home loan rate you pay.

Comentarios recientes