Secured personal loans is protected because of the a home, vehicles, or other beneficial property

- Wedding Expenditures: Matrimony expenses try a personal loan example that’s the very popular significance of individuals. Unsecured loans are widely used to purchase bigger instructions for instance the venue and you may outfits otherwise quicker of these, together with vegetation, cake, and images, otherwise a planner to have debtors that simply don’t have enough savings.

- Traveling Costs: Take a trip expenditures are an unsecured loan analogy that every borrowers want to get to. A personal loan allows borrowers so you’re able to splurge to the a honeymoon, a visit overseas shortly after graduation, otherwise a separate wedding crack if they is happy to invest it well several years later.

- Cost of Moving: Relocation cost is actually a personal bank loan analogy. The purchase price range getting regional and you can long-distance migrations is approximately $882 and you may $dos,544. Financing moving expenses, along with vehicle, furniture, supplies, and you may transport charges, occurs affordably which have unsecured loans. Offers having market, clean up offers, and you will utility places enhance the borrower stay straight.

Secured personal loans provide lower interest rates as the loan providers incur less chance. The new guarantee is forfeited once that loan are defaulted. Familiarize yourself with whether or not the borrower has money for a financial loan ahead of providing one to away. Debtors must provide property, including property, vehicle, or family savings, so you’re able to contain the personal debt. Banking institutions and lenders need collateral due to the fact a pledge to be sure it have the straight to assemble the money if debtor defaults. Lenders may offer all the way down rates of interest due to the fact most cover reduces the risk of economic loss. The lending company factors borrowing in order to borrowers which have lower fico scores or terrible monetary records as the collateral reduces the chance of losses in standard.

Lenders offer all the way down interest levels towards secured finance due to the lesser risk involved, drawing debtors in search of much more cheap financial loans. Secured finance are helpful according to the debtor’s economic points. The application processes now is easier, that’s beneficial in the event your borrower’s credit was poor. And work out quick costs grows a credit rating. You can find tall punishment of defaulting for the a guaranteed loan. Defaulting to your costs results in shedding them. Signing up for a protected loan requires the debtor to settle the mortgage.

Rates of interest having secured loans are often less than unsecured loans. There are particular conditions, in addition to identity money, pawn fund, and you can fund to possess debtors with poor credit who have highest focus prices. Browse the conditions and terms during the a binding agreement prior to signing they. Such as for instance, a guaranteed financing to possess bad credit is actually a personal loan. This type of funds installment loans online North Carolina is for borrowers that have bad credit suggestions. Loan providers generate negative-credit unsecured loans, but they need some form of economic collateral just like show-secured finance, protected credit cards, and safeguarded personal lines of credit. Protecting a loan having less than perfect credit and lower credit ratings keeps highest charges and you may interest levels.

Whom Comes with the Signature loans?

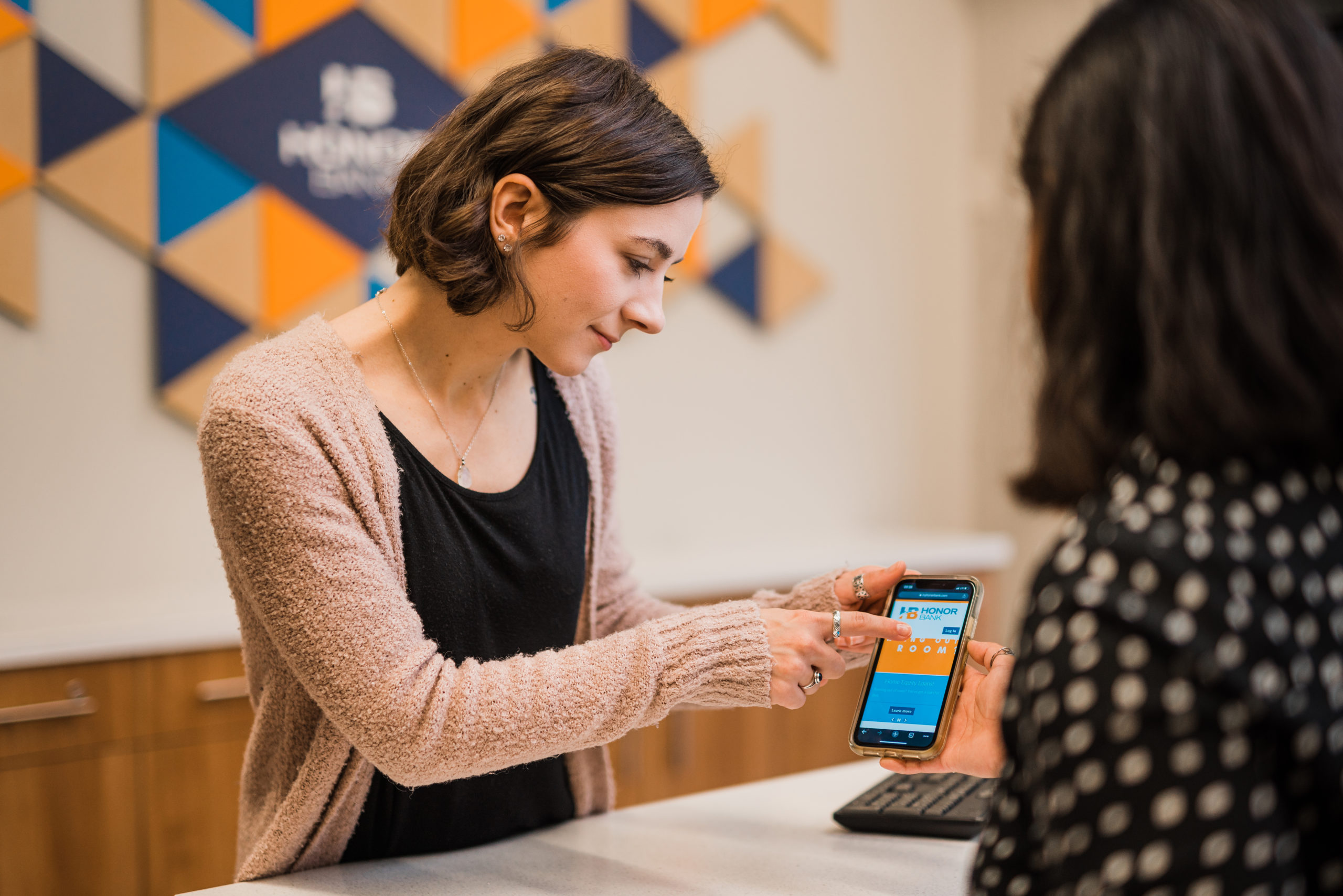

Banking institutions, borrowing unions, an internet-based lenders provide unsecured loans. Finance companies, borrowing from the bank unions, and online lenders give unsecured loans to individuals to view money for several uses. Personal loans was a financial unit you to borrowers used to consolidate personal debt, generate house variations, buy medical expenditures, or realize most other individual requires.

Financial institutions and you can borrowing from the bank unions are usually loan providers private financing. People commonly need a great credit rating and a constant income to help you be eligible for a loan. Such associations provide attractive rates of interest and criteria to customers with long-updates dating otherwise strong borrowing from the bank profiles. And get personal loans out of well-understood brick-and-mortar teams, and this manage a feeling of safeguards and you will reliability.

The organization away from on line financing has grown accessibility signature loans. Online loan providers explore technology so you can shorten the program processes and work out fast lending choices. It serve a varied spectrum of credit users, such as the of those which have shorter better credit scores. On the web loan providers be a little more obtainable and you will easier, but borrowers need to find out these loans come with higher costs and you can interest levels than simply typical loans. Many individuals however thought on line lenders while the finest unsecured loan business making use of their convenience and you can the means to access.

Comentarios recientes