Key takeaways

- There are lots of differences when considering HELOCs, unsecured loans and you may credit cards.

- HELOCs were putting on when you look at the dominance once the home prices features risen.

- Looking at the huge benefits and you can cons regarding funding helps you influence the best choice.

You will be going to continue a house renovation, purchase training, or help your house be eco-amicable that have residential solar panels or ideal insulation. Whenever financial support needs, it will help to accomplish a gut-see about and this option is right for your specific problem. However with too many possibilities around, how do you learn that’s best for you? Let’s acquire some quality by looking at around three chief money provide: HELOCs (household security credit lines), online payday loan Mississippi unsecured loans and you may credit cards. Immediately after doing some look, you are able to we hope become self assured as much as your decision.

Which are the head differences when considering good HELOC, personal bank loan and you may a credit card?

Some fundamental differences between a house security credit line, a personal bank loan and you may credit cards try interest levels, cost terms, fees and you will loan quantity. It will help so you can map out this new plan of your particular words in the for every selection when creating decisions that will apply at future goals. This is how the three type of financing break apart:

HELOC: A beneficial HELOC try a personal line of credit the place you borrow cash against the security of your house. You have heard the popularity of HELOCs could have been rising and home prices. A unique title getting a good HELOC is actually a second home loan, and therefore essentially metropolises an effective lien on the household. A broad principle for how far collateral is needed to find a beneficial HELOC, it is 20%, even though some organizations differ thereon shape. HELOCs usually feature all the way down APRs (annual commission costs) than simply credit cards or personal loans, however, there is certainly yearly charge in it. So you can assess just how much guarantee you’ve got of your house, you simply use the difference in the value of your property and you can everything you nevertheless are obligated to pay in your mortgage. Once you’ve calculated a full amount of equity, your ount. The borrowed funds-to-really worth (LTV) proportion will be your most recent financing balance separated because of the appraised worth in your home. An enthusiastic LTV off 80% is recognized as greatest by many financial institutions. It means they won’t allow you to carry loans that’s so much more than 80% of residence’s worth. It obligations includes your existing home loan and the new loan otherwise line of credit.

Personal loan: With a consumer loan, you may be borrowing a specific lump sum payment of money that’s next paid down over a determined time frame, constantly anywhere between a few and five years. Plus, the rate is restricted. Signature loans was unsecured (definition your house is perhaps not made use of as the security since it perform getting that have a beneficial HELOC) and can be taken the objective the brand new borrower decides, and additionally merging debt or since the price of a large expenses. Extremely, it’s to the brand new borrower on what they would like to make use of the financing.

Mastercard: Credit cards, granted from the a lender otherwise business, enables you to borrow funds towards the a moving foundation that have good variable interest rate to fund merchandise or attributes. If you don’t pay the expenses completely every month, the remaining equilibrium offers more than. The kicker? Bank card desire may be greater than it is with an excellent HELOC or personal bank loan.

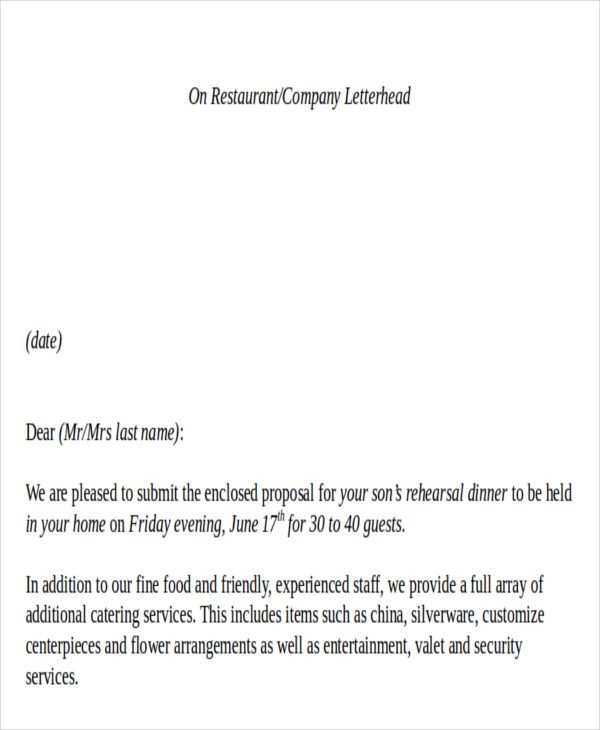

To split something down only, let’s evaluate personal loans, home equity lines of credit and you can handmade cards having a graphic. This may assist you in deciding and this choice is suitable for your lives.

Comentarios recientes