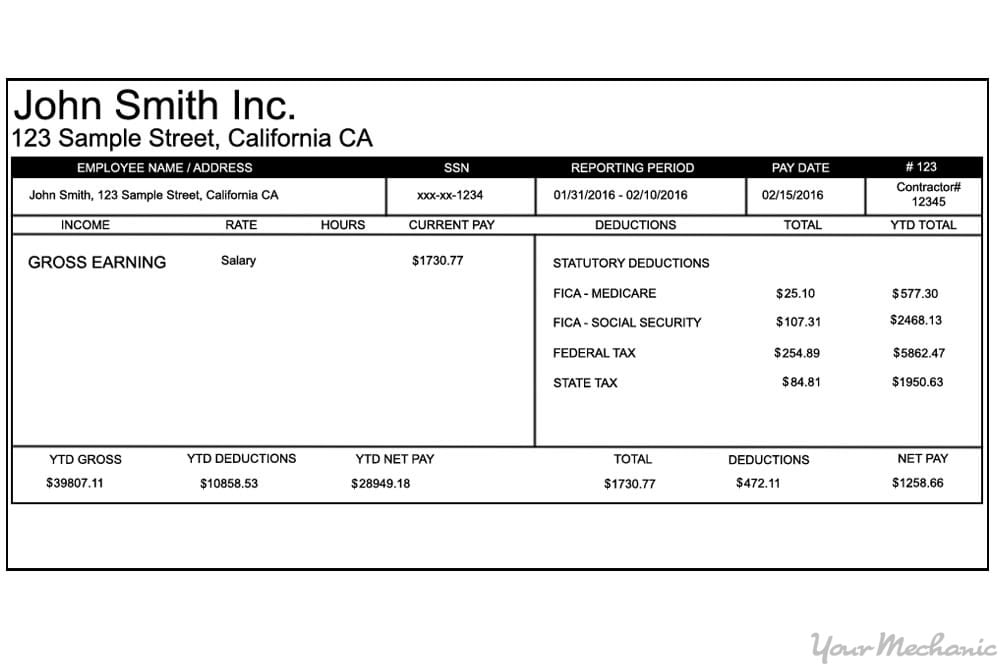

- Evidence of label, quarters and you will income

- Photocopy out-of a legitimate passport and you may visa

- Backup out-of possessions allocation page/consumer arrangement otherwise arrangement to offer, when the home is currently shortlisted

- Passport size pictures of all individuals

- Cheque on processing charge

- Power regarding Attorney when the relevant

Home loan processes:

To apply for a mortgage, you ought to fill out the fresh new properly filled financial form also the needed data on financial sometimes directly otherwise due to a beneficial POA owner.

Power off lawyer:

Its preferred by hire many members of the family once the Fuel from Attorneys (POA) owner for the India. This new POA manager could well be eligible to operate on the part bad credit loan Deer Trail of you according to the power offered beneath the POA agreement and you can the physical presence need not be expected constantly to own processing/assisting your property mortgage.

Limit amount borrowed:

Generally between 75% and 90% of the house cost is offered since the that loan. The balance could well be their contribution.

Tenure:

You can avail an optimum title as much as two decades dependent on the character such as your age during the readiness from mortgage, ages of property at the mortgage readiness or any other terminology.

Rate of interest:

You may choose a changeable rate mortgage otherwise an excellent fixed rates mortgage (where rate of interest is restricted for 2 otherwise 36 months, blog post that the loan usually immediately become an adjustable speed, adding up so you’re able to an entire term out-of twenty years). Interest rates due to the fact relevant will be levied on the disbursed mortgage.

Installment of houses loan:

If you intend to acquire a less than-construction assets, you pay only the focus till their conclusion just after which you can initiate the EMIs. Yet not, if you would like begin paying down the dominant as well, it’s also possible to decide to tranche the mortgage and begin make payment on complete EMIs. While you are to shop for a completely constructed property, your EMIs would start quickly. The EMI money must necessarily occurs via your NRE/NRO family savings from inside the India. There’s no punishment to possess pre-payment out of limited or full value of one’s an excellent amount borrowed paid down of own source. Your mortgage can get attention prepayment costs in case you is refinancing it to another standard bank in the India.

Income tax deduction to possess mortgage:

Youre eligible to a taxation deduction into interest paid off and you can mortgage cost on your own financial when you’re an NRI according to the income tax definition and document your income taxation production during the Asia. Youre eligible for deduction as high as Rs.1.5 lakh for the property loan dominating cost not as much as section 80C and you can as much as Rs. dos lakh toward desire money when your residence is sleeping vacant. When it is leased away, the whole focus payable is claimed as exception to this rule.

Do you realize?

- You could potentially take advantage of Home loan Consultative Characteristics in the united states where you currently live, for purchase from property located in Asia.

- You might avail a home loan for buying another type of house, resale domestic, developing your home on a storyline belonging to you, for sale of a land, do it yourself and you will domestic extension.

- All of the remittances regarding exterior India with the very own sum or EMI repayments need to necessarily takes place via your NRE/NRO checking account in the India.

- You don’t need to be present when you look at the India in order to avail disbursement of your home financing. Your time out-of Attorney can be perform they to you.

In the event you go back to Asia permanently, hence changes their reputation regarding Non resident Indian so you can Resident Indian, the financial institution could possibly get reevaluate the loan qualification and you can payment capacity and you will workout a modified payment agenda. Although not there isn’t any biggest feeling because the a resident features unfettered liberty to track down property when you look at the India. A small change in the new taxation work with will be chance out-of therapy of you to definitely family just like the notice-filled.

Comentarios recientes