Ashley Wirgau

Focusing on how collateral yields within confirmed house is an important course for any citizen, but it’s especially important of these traditions within this a manufactured family. Such portable formations do not constantly hold worth in identical way a classic property can.

Therefore, comprehending the particulars of the mobile market is good grand assist for these working to create equity inside their own are created home. First off, why don’t we explore some basic concerns which can begin to paint an effective image of the newest guarantee possible in your are made home sweet household.

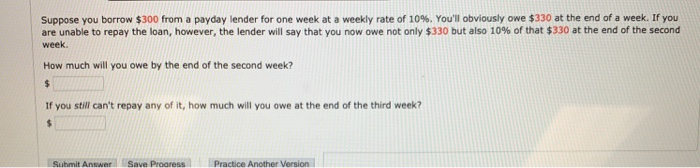

Is your Interest rate Over Mediocre?

Whenever securing funding getting a created domestic, borrowers are confronted by somewhat highest interest levels as opposed to those in search of a timeless property. Because of this, are formulated home commonly make security from the a slowly pace much more of each and every payment are seriously interested in settling the latest racking up attract. As opposed to a stick-based home, finance companies usually loans are created homes eg an auto in the place of a house as these properties try regarded as being higher risk towards bank. Thus, a higher interest rate was connected to let counterbalance the prospective to have standard.

One method to restrict that it additional cost is always to generate a big down-payment initially, and that cutting your overall incentives count. Should you currently become multiple money to the home loan, you could potentially, as an alternative, make use of evaluating Ruoff’s refinancing possibilities. We could possibly you should be capable help get your fee to a more in balance number and you will, thus, push the fresh collateral of your house upwards in which they belongs.

Exactly how Cellular will be your House Just?

It can be entitled an effective mobile household, but simply how cellular will it be very? This 1 foundation makes a massive affect the fresh home’s equity prospective. Are available home that will be forever attached so you can property owned by the new homeowner will delight in when you look at the worth comparable to a traditional generate carry out. Such as, devices attached to a permanent basis, real slab otherwise cellar are those probably to create equity similarly to a traditional domestic. But not, individuals who can be found on the home which is rented, even tools which might be permanently linked to said residential property, usually do not follow this development.

Also, are produced residential property which can be with ease found and moved to good the latest location hardly ever accrue worth at all. Rather, such cellular phone kinds of formations depreciate much like a motor vehicle or camper truck do over time. He is seen because of the appraisers and you can banking companies equivalent once the closer to individual possessions than real possessions, so the most sensible thing can be done as an owner out-of for example a property would be to remove all question that your house may find a new family.

Really does Size Matter to you personally?

…as it could to the financial. With regards to cellular home units, size really does amount. Single greater residential property (usually obtaining somewhere below 1,000 square feet) will most likely not fulfill lowest measurements standards for any variety of domestic equity financing. Home owners searching for securing future investment of this type should think about updating so you can a larger mobile tool my explanation toward front end to be sure available lines of credit later.

It has to additionally be noted a large number of loan providers excused are formulated land away from becoming included since security when it comes down to lines of credit, judging these structures become a shorter sound funding towards the bank. Again, dimensions extremely merely things while concerned about building security inside the home to help you as time goes by borrow against it, regardless of if a quarrel was produced you to definitely potential future consumers carry out also see really worth in the a much bigger quarters, so choosing the twice-wider choice could put you to come in any event.

Complete, when it comes to are made residential property sure, collateral do have a tendency to make on a lower price provided multiple facts. These types of parameters tend to be probably highest rates, practical question of permanency, house possession as opposed to hired loads, and overall square footage of the house by itself. However, for example functions everywhere, a produced house’s collateral often is dependent on external forces. The key to and work out those forces be right for you as well as your form of are built house is wisdom those would be addressed just before you actually also generate that basic payment.

Comentarios recientes